Secure your payment terms. Pacify your business relationships with PAYCIFI.

The cheapest escrow on the market, starting from 1$/€.

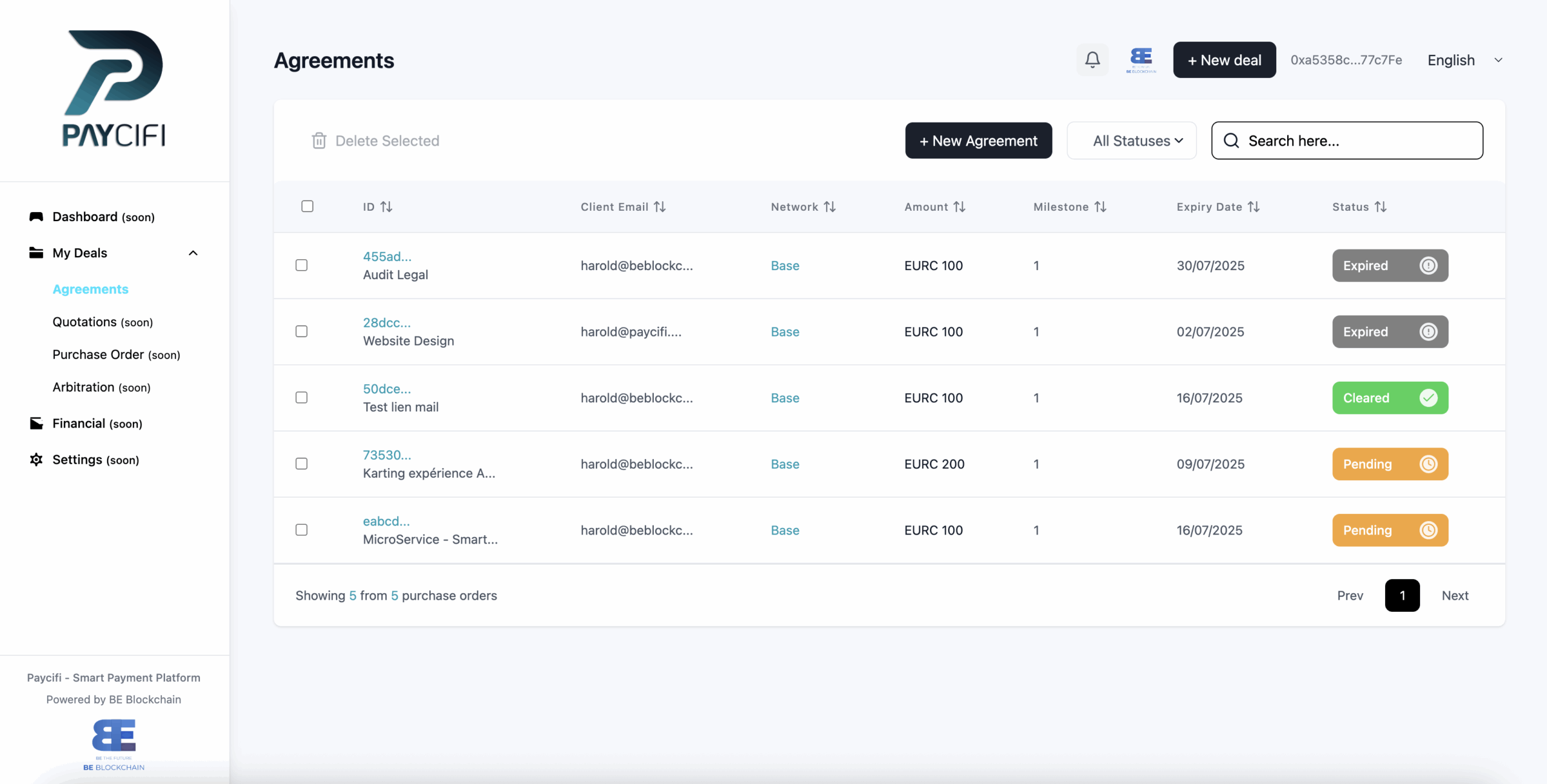

Create agreements, quotes, or purchase orders, set your rules with our programmable escrow, invite your partners, and redefine trust in every transaction.

Our PartnersThey Trust Us

Smart Escrow

Our SolutionWelcome to a new era of smart payments

Self-Custodial Blockchain Escrow

Security aligned with industry standards (ISO 27001)

Regulated Banking Partners for fiat ramp

Paycifi is a smart payment platform designed to secure and automate simple or multiparty financial agreements by eliminating traditional frictions related to conditional payments, contract disputes, and settlement delays.

In other words, Paycifi programs trust by ensuring that payment terms and conditions are executed as agreed, while simplifying dispute resolution through an integrated arbitration system.

Designed for Instant Adoption

- Social and Email onboarding

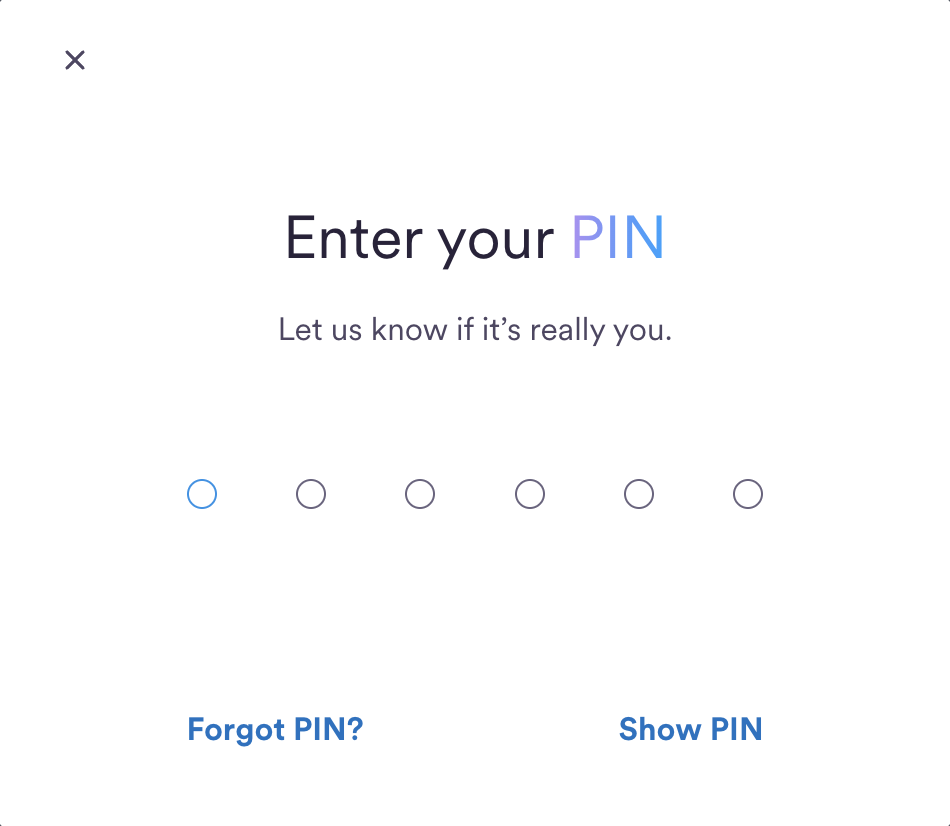

- PIN-based transaction approval

- Fiat to stablecoin rails

- MPC Management

Proven Infrastructures

The Problem We SolveThe Hidden Cost of Doing Business

Unpaid Invoices

72% of freelancers have unpaid invoices from clients, often totaling as much as $50,000 (Electro IQ).

Payment Delays

In 2023, the share of EU companies facing payment delays (≈62 days) rose to 47%, the sharpest increase in five years.

Trust Issues

43% of suppliers report trust issues with clients over payment terms (PwC), often resulting in payment delays, disputes, and strained relationships.

Costly Disputes

As per a study by the law firm Norton Rose Fulbright, 52% of companies have been involved in a legal dispute in the past two years.

As easy to use as a payment platform, yet as powerful as a notarized contract.

FeaturesProgrammable Trust

The power of Web3, the simplicity of Web2

Paycifi is a smart payment platform that merges the power of Web3 smart contracts with the simplicity of a Web2 user experience. The platform is designed to be as intuitive as a traditional payment gateway, while supporting advanced features like milestones, revenue sharing, conditional payouts, and built-in arbitration. Upcoming features include data oracles, fiat on/off-ramp integrations, and abstracted smart accounts, making blockchain complexity invisible to the end user.

Built for modern B2B transactions

Paycifi addresses the growing need for trust in B2B transactions, especially for SMEs, freelancers, and regulated professions. It reduces transaction costs (0.5–5% vs 3–20% with traditional models), accelerates settlement times (instant release upon approval), lowers dispute risk through transparency, and removes regulatory barriers by leveraging blockchain as the trust layer.

From escrow to smart workflows

As a programmable transaction infrastructure, Paycifi aims to become the new standard for conditional digital payments. It enables businesses, freelancers, and professionals to create secure multi-party financial agreements without relying on banks or escrow agents. Funds are locked in a non-custodial smart contract deployed on EVM-compatible blockchains, and only released when predefined conditions are validated. This mechanism acts as a programmable escrow, guaranteeing client solvency, service compliance, and mutual protection. In essence, Paycifi automates trust where contracts and lawyers set the legal framework.

From escrow to smart workflows

Achieved a 95% customer satisfaction rate across all AI solutions.

From escrow to smart workflows

Cost Savings

Delivered over $10 million in cost savings for clients through optimized AI solutions.

PricingOnly pay when your contract is completed.

FAQEverything you need

to know about

If a dispute arises, any party can trigger arbitration through Paycifi. It is strongly recommended that all parties have agreed in advance to accept the arbitrator’s decision to resolve the conflict efficiently. Otherwise, a court ruling can still be enforced.

Once arbitration is triggered, the funds are automatically moved to a new smart contract with the allocation reset. Only the arbitrator, either independently or following a court decision, will be able to assign a new allocation among the parties, including a predefined fee for their service.

Yes. Paycifi enhances legal compliance by providing a transparent, enforceable, and auditable payment mechanism. Paycifi uses the blockchain itself as the escrow, ensuring funds remain non-custodial and secure until all predefined conditions are met. The platform acts as a service layer on top of this escrow, making it easy to create, manage, and execute conditional payments without intermediaries. It does not replace contracts but complements them. For international use, it is advised to pair your Paycifi deal with a signed agreement or clear email confirmation to reinforce legal enforceability if needed.

Not necessarily. The upcoming version of the platform (V2) will support smart accounts and fiat on/off-ramp integrations, allowing users to operate entirely in euros or dollars without any blockchain knowledge or wallet setup.In this regard, Paycifi is supported by the Walloon government to integrate its Web2.5 modules.

Paycifi is faster (real-time release upon validation), more cost-efficient, and more flexible. You define the payment rules, select your partners and arbitrator, and keep full control over the deal. No third party holds your funds and there are no hidden fees.

Unlike platforms such as Fiverr, which tend to favor buyers in dispute resolution, Paycifi offers a balanced framework where both parties have equal control and transparency throughout the transaction.

No. Thanks to its blockchain-based infrastructure, Paycifi does not act as a financial intermediary and never holds user funds. The smart contract itself serves as the escrow, making the system non-custodial by design. This removes the need for costly licenses or regulatory approval, while ensuring full transparency and auditability on-chain.

To guarantee the integrity of the mechanism, security audits have been conducted and will continue to be performed to validate the correct execution of the smart contract code.